Value Investing

“You get rich investing in companies that cost less than they are worth.”

(Benjamin Graham)

“Value Investing” in Value-Holdings AG

1. Definition and history

Value investing, or value-oriented investing, refers to an investment strategy in which decisions to buy or sell securities are based exclusively on intrinsic value. A comprehensive fundamental analysis is therefore required to implement this investment strategy.

In 1934, Benjamin Graham, an economics professor at Columbia University, and David Dodd, then a lecturer at Columbia University and later an American economist, published their book “Security Analysis”. In the following years, this book became the standard work on share valuation and the guideline for many successful value investors. In 1940, the book was revised, supplemented with practical experiences since the intervening six years and published as the “1940 Second Edition”. Benjamin Graham’s most famous student, Warren Buffett, has called this “1940 Second Edition” the best book on financial analysis ever written. He became the richest person in the world for a time by consistently implementing the strategy, with a fortune of around $80 billion.

Benjamin Graham places the careful analysis of the company that has issued securities (issuer) at the centre of his considerations. “Analysis means the careful study of the available facts with an attempt to draw conclusions from them on the basis of established principles and sound logic “, says Benjamin Graham. For Graham, the focus is on the issuer, i.e. with the company as a whole. The individual share and the stock market price are of secondary importance.

The ultimate goal of the analysis is to determine the intrinsic value of the company, or the difference between the market price of a security and its intrinsic value. Put simply, the intrinsic value of a company is the value justified by its assets, profits, dividends and future prospects.

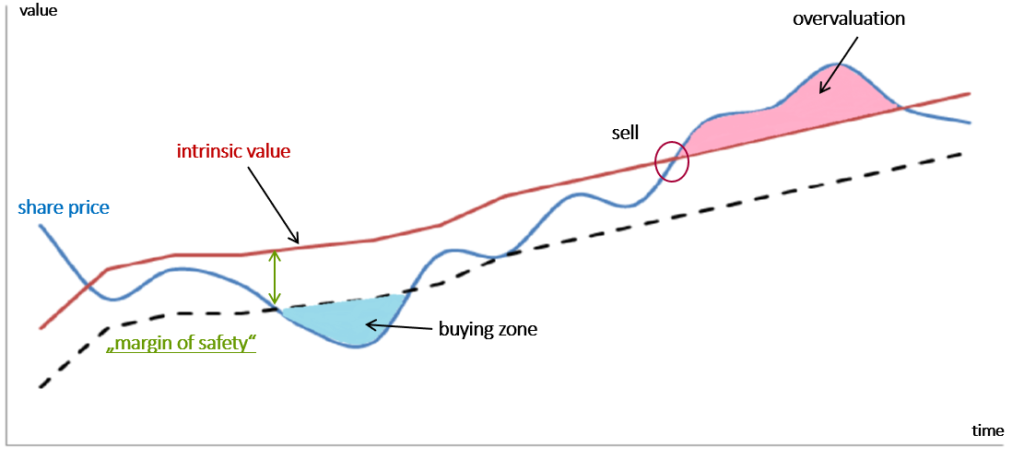

Once one has a reliable idea of the intrinsic value of the company, the next step is to find shares whose market value on the stock exchange is significantly below the respective intrinsic value. In the medium term, value investors are convinced, the stock market will make up the difference between market value and intrinsic value. According to Benjamin Graham, buying shares at a discount to their intrinsic value has another advantage: the “margin of safety”. For undervalued securities, by definition the difference between the market value and the higher intrinsic value is the margin of safety available to offset the effects of a mispricing of intrinsic value or lower earning power than assumed in the valuation. A portfolio consisting of shares bought with a margin of safety will therefore, according to Benjamin Graham’s conviction, be more stable in stock market downturns than a portfolio of shares without a margin of safety.

2. Selection criteria

At Value-Holdings AG, the selection of potential shares is based on three criteria: “Good Business”, “Good People” and “Good Price”.

When assessing the “Good Business” criterion, it is indispensable to understand the business of the company. Warren Buffett says: “You need to fully understand the business purpose of the companies behind the shares.” This is important in order to be able to develop an accurate idea of the company’s market positioning, its potential sustainable earning power and the value of the company. At Value-Holdings AG, this means that companies from the banking, insurance, biotech, pharmaceutical, etc. sectors, for example, are not included in our investment universe. In the biotech and pharmaceutical sectors, we believe that financial ratios play a subordinate role. What matters here is the effectiveness of the products, the development pipeline and the likelihood of approval of active ingredients or drugs. We are unable to assess these important influencing factors. In the case of banking and insurance companies, we also believe that important influencing factors such as the quality of the credit or insurance portfolio or risks from derivative positions cannot be adequately assessed by an external balance sheet reader. Furthermore, we avoid companies from industries that are subject to high regulatory intervention, such as utilities, alternative energy producers and telecommunications providers. The energy policy of recent years has shown how drastically legislative and regulatory interventions in the market can affect the business development of affected companies.

In positive terms, we focus on companies from the manufacturing industry, the consumer goods industry and the service sector. Within these industries, we select companies with healthy balance sheets, low debt levels and the ability to command reasonable prices for their products.

When assessing the criterion “Good People”, we believe that getting to know the management personally is an advantage. Assessing the professional qualifications of management or the board of directors is inherently difficult, especially if you yourself do not come from the industry in question and have no business connection with the company. Research on the internet about previous activities sometimes brings interesting news to light and is suitable to round off the personal impression.

Value-Holdings AG addresses this issue with a catalogue of questions that scrutinise management’s actions: Does management act rationally? Is management communicating honestly with shareholders and how has the quality of forecasts been in the past? How often were changes in the Executive Board and the Supervisory Board and what were the reasons? Does the management prefer organic growth or does it instead focus on acquisitions with the risk of too high purchase prices and the danger of write-offs due to the impairment test? Even if a point system is installed for these questions, as in our case, the assessment remains highly subjective, influenced by bias and personal inclinations.

3. Investment universe

“Concentrate your investments on a few selected stocks,” says Warren Buffett. Value-Holdings AG has analysed around 2,000 listed companies in Germany and Europe in recent years. Even for us as professional investors, however, it is not possible to continuously track this high number of companies. The stringent application of our selection criteria ultimately reduces the stocks included in our investment universe to just under 250.

After further qualitative analyses, only 20 to a maximum of 40 stocks from this investment universe qualify for our portfolios. Even if we are convinced that the companies in our investment universe are good companies with good management, the stock market does not always do us the favour of offering the share at a favourable price with a high margin of safety.

4. Evaluation

When valuing or calculating the intrinsic value of a company or a share, Value-Holdings AG applies a multiplier model developed in-house. The DCF model (discounted cash flow) preferred by many participants in the financial markets is not used by us, as this method requires too many assumptions to be made in uncertainty. This starts with the necessary, detailed 5-year planning, taking into account the company’s investment needs, in order to be able to determine the achievable free cash flows. Subsequently, a perpetual growth rate is to be determined in order to calculate the “terminal value”. It is assumed that the company will exist in perpetuity and generate free cash flows. The calculated cash flows are then discounted to their present value. Here the problem of the correct discount factor arises. Furthermore, an appropriate risk surcharge shall be taken into account.

This method is too vague for us. In case of doubt, it is already uncertain to reliably estimate a company’s earnings for the next one or two years. For this reason, in addition to past values, only future expectations regarding the development of earnings for the current and the following business year are included in our model. The multiples model of Value-Holdings AG is two-pronged: one calculation method focuses on the company’s earning power when calculating the intrinsic value. The second method of calculation weights the substance, i.e. the assets of the company, higher than the earnings. Finally, the two values determined in this way are added together and divided by two, so that the intrinsic value we determine gives equal weighting to substance and earning power.

5. Conclusion

The decisive factor in the valuation of companies is not to determine an exact intrinsic value. It is sufficient to determine whether the intrinsic value, or the value a reasonable investor would pay for the entire company, is reasonable in comparison to the current market price or whether it is significantly lower or significantly higher.

Exploiting this difference is the goal of the value investor. “Price is what you pay. Value is what you get”, says Warren Buffett. By purchasing at market prices (rates) significantly below the intrinsic value of the company, the chance of an above-average performance of the portfolio increases. At the same time, the low purchase price provides a risk buffer in market downturns through the “margin of safety”, which can prevent the investment from falling in price value to the same extent as the market as a whole. An old merchant’s saying also underlines the importance of the purchase price: “In buying lies the profit”.

Examples of value companies in the value holdings portfolios